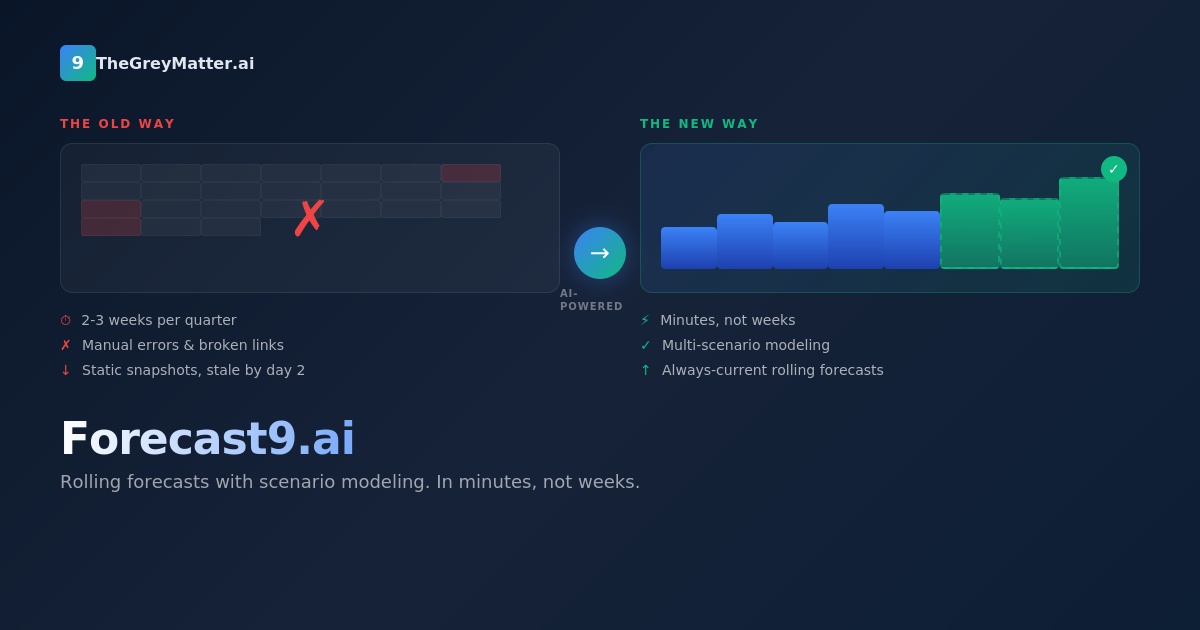

And How AI-Powered Rolling Forecasts Can Give Everyone 2-3 Weeks Back Every Quarter

By Edwin A. Miller | Executive Chairman, TheGreyMatter.ai

Let me paint a picture every CEO, CRO, CFO and FP&A leader knows too well.

It’s the second week of the quarter. Your finance team is buried in spreadsheets, pulling data from six different systems, reconciling numbers that don’t match, and rebuilding formulas someone accidentally broke. The board meeting is in ten days. Your CEO needs the updated forecast yesterday. And that “quick” sensitivity analysis the PE sponsor requested? It’s going to take another week.

This isn’t a failure of your team. It’s a failure of the tools you’re forced to use.

The Spreadsheet Trap

Here’s what most companies don’t talk about openly: the quarterly forecasting process typically consumes 2-3 weeks of FP&A time every single quarter. That’s 8-12 weeks per year—nearly a quarter of your finance team’s capacity—spent wrestling with spreadsheets instead of providing strategic insight.

The irony? By the time your forecast is “finished,” it’s already stale. Market conditions shifted. A key customer churned. Your sales pipeline moved. The beautiful 18-tab Excel model you just finalized is a snapshot of a reality that no longer exists.

I’ve lived this reality. As CEO many times over, I watched brilliant finance professionals spend countless hours manually pulling data from our ERP, CRM, and billing systems, then painstakingly building driver-based models that took days to update when assumptions changed. It wasn’t sustainable, and it certainly wasn’t strategic.

What Modern Forecasting Should Look Like

When I set out to build TheGreyMatter.ai, I wanted to solve the problems I’d experienced firsthand. Forecast9.ai, our rolling forecast generator, was born from a simple question: What if your forecast could update itself?

Here’s what AI-powered forecasting delivers. First, it automatically ingests data from your ERP, CRM, HRIS, and billing systems—no manual exports, no copy-paste errors. Second, it generates rolling 12–18-month forecasts with monthly or quarterly granularity, continuously updated as new data flows in. Third, it creates multiple scenarios—base case, upside, downside—with probability weighting, so you’re not presenting a single number but a range of outcomes. Fourth, it performs sensitivity analysis on key assumptions instantly. What happens if churn increases 2%? If deal cycles extend by 30 days? If you hire 10 more reps next quarter? You can answer these questions in seconds, not days. Finally, it produces board-ready presentations and executive summaries automatically, turning raw projections into the narrative your stakeholders need.

The Strategic Shift

The real value isn’t just speed—it’s the strategic capability you unlock when your finance team isn’t buried in spreadsheet maintenance.

Consider the typical CFO’s month. With traditional forecasting, week one is spent gathering and reconciling data. Week two is consumed building and validating models. Week three is dedicated to presentations and stakeholder reviews. That leaves one week—at most—for actual strategic analysis and decision support.

Now flip that equation. When forecasting happens continuously in the background, your finance leaders spend their time on what matters: identifying risks before they materialize, spotting opportunities in the data, stress-testing strategic initiatives, and advising the business on capital allocation.

This is the transformation we’re enabling at TheGreyMatter.ai. Forecast9.ai is part of a broader ecosystem of 37 specialized AI agents, each designed to eliminate the manual, repetitive work that keeps executives from focusing on strategy.

The Path Forward

If you’re a CFO or FP&A leader still managing forecasts in spreadsheets, I’d encourage you to ask yourself: What would you do with 8-12 weeks of capacity back? What strategic questions could your team answer if they weren’t buried in data reconciliation? What decisions would you make faster if you had rolling, always-current projections at your fingertips?

The technology exists today. The question is whether you’re ready to make the shift.

Forecast9.ai is now available through TheGreyMatter.ai platform. If you’d like to see how it can transform your forecasting process, I’d welcome the conversation.

— — —

Edwin A. Miller is Executive Chairman of TheGreyMatter.ai and a multi-exit CEO with experience transforming startups, PE-backed companies, and public companies. He previously served as CEO of Marchex (NASDAQ: MCHX), where he delivered the company’s first positive EPS since 2013. Edwin holds a U.S. patent for automated analytics ingestion and was recently recognized as one of the Top 25 Tech CEOs of Seattle for 2025.